how much is my paycheck after taxes nj

How much tax is taken out of a 500 check. Calculating paychecks and need some help.

New Jersey Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Does NJ have state income tax.

. How much do you make after taxes in New Jersey. The take home pay for a single filer who earns 80000 per year is 5986280. Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay.

Your average tax rate. New Jersey State Payroll Taxes New Jersey has a progressive income tax policy with rates that go all the way up to 1075 for gross income over 5 million. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

The state income tax rate in New Jersey is progressive and ranges from 14 to 1075 while federal income tax rates range from 10 to 37 depending on your income. Some states follow the federal tax year some. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and.

Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Heres a step-by-step guide to walk. How to calculate annual income.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New. The result is that the FICA taxes you pay. The state tax year is also 12 months but it differs from state to state.

File and Pay Employer Payroll Taxes Including. State of New Jersey levies a state personal income tax and state corporate income tax and a state sales tax. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

New Jersey Salary Paycheck Calculator. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Employer Requirement to Notify Employees of Earned Income Tax Credit.

Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. For example if an employee earns 1500. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

That means that your net pay will be 43041 per year or 3587 per month. Just enter the wages tax withholdings and other information required. For a married couple with a.

Commuter Transportation Benefit Limits. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. You are able to use our New Jersey State Tax Calculator to calculate your total tax costs in the tax year 202223.

New Jersey Hourly Paycheck Calculator. Divide your annual salary by 52 to calculate your gross weekly pay if your employer compensates you on a salary basis. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and.

Our calculator has recently been updated to include both the latest Federal. What payroll taxes do employers pay.

New Jersey Paycheck Calculator Smartasset

![]()

Free New Jersey Payroll Calculator 2022 Nj Tax Rates Onpay

Phlebotomy Technologist Salary In Newark Nj Comparably

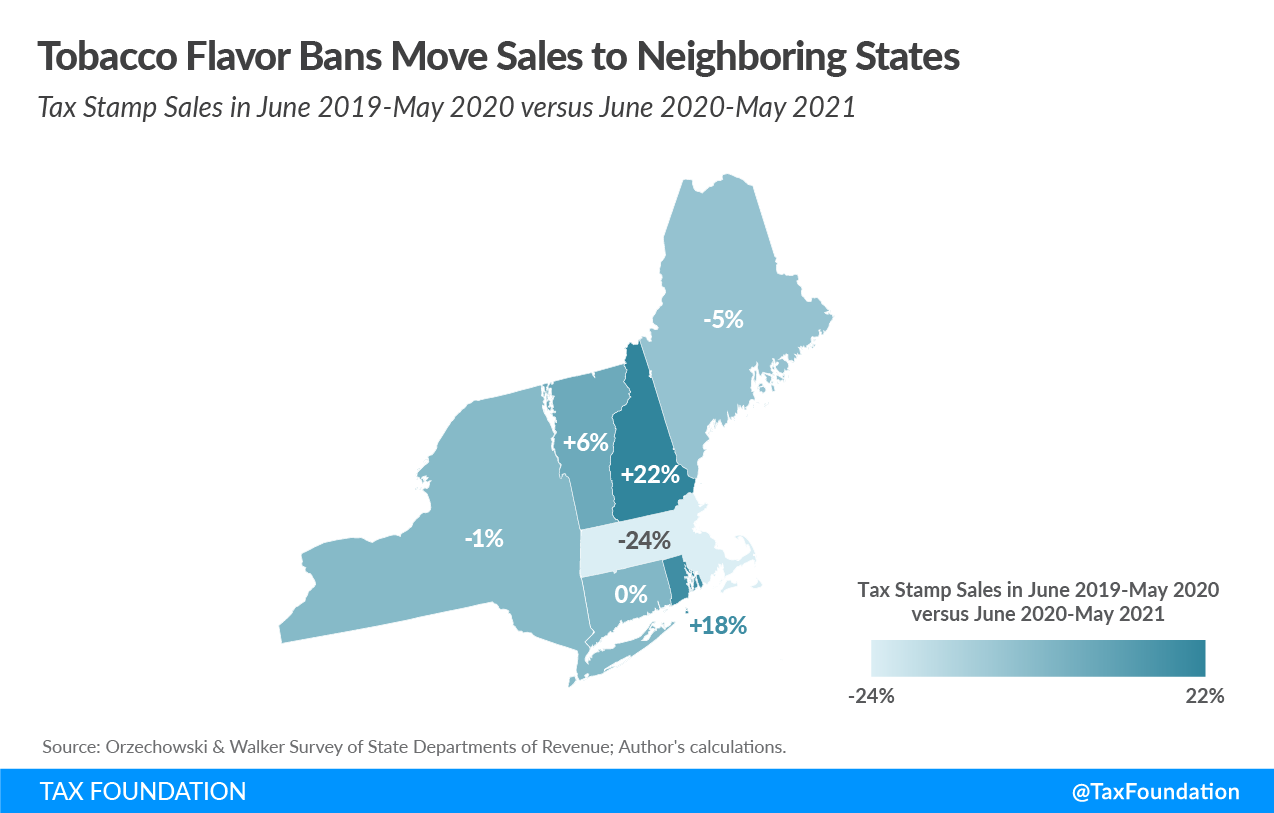

New Jersey Tax Rates Rankings Nj State Taxes Tax Foundation

Is It Possible For A Weekly Salary Of 500 To Have Over 100 Of Taxes Taken From Each Paycheck Quora

New Jersey What Is My State Taxpayer Id And Pin Taxjar Support

State Income Tax Rates And Brackets 2022 Tax Foundation

An Overview Of The New Jersey Exit Tax Vision Retirement

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Free Payroll Tools For Small Business Owners Quickbooks

Township Of Scotch Plains Nj Online Payments

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Senator Troy Singleton Recently The New Jersey Department Of Labor Announced An Increase In The Unemployment Insurance Tax That Businesses Will Pay Come October 1st This Increase Comes At A Particularly

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com